What is Pre-Approval?

If you are looking to purchase a property (such as a home, vacation home, condominium, investment property) in order to have a realtor take your offer seriously, you need to get pre-approved for a loan. You need to be able to show that you can afford the purchase price and the mortgage payment, that you have the down payment and will qualify for the needed loan amount.

Pre-approval is getting an underwriting approval for the borrower that is substantiated by your credit report, income documentation, and asset documentation up to a purchase price amount for specific property types such as single family residence (SFR), duplex, triplex, and fourplex in residential lending.

Why Get Pre-Approved?

Once a borrower is pre-approved, realtors will take your offer seriously. A pre-approval letter is the lynchpin — an actual document to show that you can get the loan needed to complete the sale.

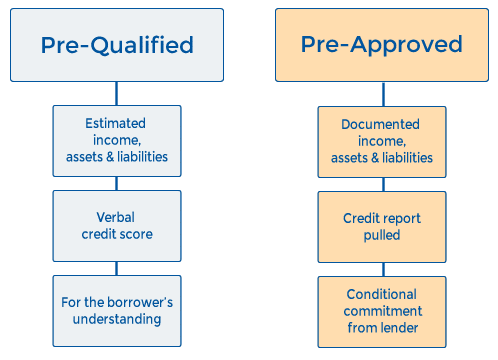

Pre-Approved vs. Pre-Qualified

Being Pre-Qualified For a Loan Is Not Enough

Pre-qualification is simply a loan agent’s opinion, a verbal assessment of your potential ability to obtain a loan based on a conversation. To get pre-qualified, you may have even filled out an application for a loan, but your data has not been verified by substantiated paperwork.

In contrast, pre-approval is substantiated by a credit report, income documentation, and asset documentation.

Getting pre-qualified is fine when you are thinking about buying a property, as a first step for your own information, to understand what you can afford. But it’s not what realtors want to see when you turn in an offer. They want the borrower to have applied, provided the supporting paperwork to have their data validated by an underwriting process and personally verified by a mortgage lending professional, i.e. me.

How to Get Pre-Approved

How We Get You Pre-Approved

The pre-approval process is similar to applying for a loan. I will collect your data and verify your supporting documents, just like a loan application. This data includes:

- Social security number

- Proof of employment

- Proof of income

- Tax documents

- Current Residence

- Bank information

- Credit information

We use an automated underwriting system that allows me to enter these data points. From that, I can determine the maximum purchase price you can afford, what your down payment needs to be, and the loan amount you will be able to obtain.

FAQs About Pre-Approval

Many people worry about how having your credit run for a pre-approval, sometimes called a “hard check,” affects your credit score. Hard checks occur when you apply for a mortgage or auto loan. Credit card applications, student loans, personal loans, and apartment rental applications also trigger hard checks. In general, a hard credit check may lower your score around 5 points. Many big lenders will automatically re-run a credit check every 90 days, but we don’t want that.

However, your credit can be checked multiple times for a single purpose (i.e., applying multiple times for a car loan) in a single 30-day window, and that only counts as one incidence.

Note: A “soft check” is when you check your own credit, or if a potential employer accesses your credit profile as part of a background check.

Quicken Loans, Rocket Mortgage, the fill-in-the-blanks form on your bank’s online banking interface, all of these online loan approval systems are designed to benefit them, not you. They want to gather your data and determine if you are, on the surface, a profitable lead and they won’t look beyond that.

If your numbers alone are not pristine, you will not get anywhere with them. And if you do have good numbers, they are not going to shop your profile to 100 different lenders to determine for the best loan for you. That’s what I do. They will offer you whatever loan product they have. Also, none of them will generate a pre-approval letter.

A mortgage loan originator, or MLO, is a mortgage consultant who helps a prospective home buyer get the mortgage they need for a real estate transaction. They work with the borrower from the beginning of the transaction to the end, from the initial consultation and application through approval and the closing process. In the eyes of lenders, the originator is responsible for initiating the loan process. An MLO can be a lending company, mortgage consultant/broker like Vic, or loan officer.

Mortgage consultants, AKA mortgage brokers, are finance professionals who help people buy homes and investment properties with financing that fits their circumstances. The consultant’s relationship with buyers includes:

- helping buyers understand the arbitrary rules of mortgage lending

- presenting buyers with realistic buying options

- advising them on making a choice that fits their needs and financial resources

Knowledge: In general, the mortgage consultant needs in-depth knowledge about the mortgage industry, enabling them to:

- provide accurate current mortgage rate and product information to buyers

- communicate effectively with lenders

- help clients get approved through inside knowledge of lender practices

- manage loan documents, the loan process, and closing

Skills: A good mortgage consultant will excel and make their clients happy if they have skills in all of these areas:

- Communication — the ability to listen to clients, understand their needs, and explain mortgage details clearly

- Social — empathy and respect for clients during stressful transactions

- Math — the ability to compile complicated data and interpret it to compare loan offerings

- Detail — accurately tracking calculations and statuses for many clients concurrently

- Decision-making — using reason and experience to help clients choose an option they will be happy with

- Desire for mutual success — using their experience and skills to help a client close on a loan

Loan officers are employees of lenders, like banks and credit unions, or mortgage brokers. In the case of a one-person mortgage broker firm, the person is both the broker and the loan officer.

If a consumer tries to buy or refinance a home through a bank or credit union, the first step is to a loan officer who works there. A bank loan officer can only offer programs and mortgage rates that their institution makes available. A loan officer gets paid by the bank either by salary with standard benefits or through a commission for sales.

In contrast, a mortgage consultant works on a borrower’s behalf to find the best loan programs and rates available from multiple lenders.

A pre-approval letter is good for 90 days from the time it’s run. Many big lenders will automatically re-run a credit check every 90 days, but we don’t want that.

I have hands-on relationship with my clients. I stay in communication with you, and I will check in with you throughout the period of time that you are looking for a property. If you tell me your data hasn’t changed, and you can provide updated documentation supporting reported income and assets, I will keep issuing a pre-approval letter until you get into contract. We may need to re-run your credit after the 90 days has expired, but not always.

Independent mortgage brokers like me are motivated in a different way. We build a relationship with you. I help you get into the position you need to be to buy the property you want. I have a vested interest in your success, and I hold your hand along the way. I shepherd the process through from start to finish, with care.

Why C2 Financial Is Better than Big Banks

My Business Is All About Relationships

One reason I work though a company like C2 is because we have strong relationships with the lenders that we work with. In a sense, we are large, C2 delivers volume, through personal relationships.

Our reputation in the industry is for being brokers who are being highly knowledgeable about the loan and underwriting process. And for being able to talk to individual underwriters and negotiate deals for our clients.

Our job is not only to go over your stats and specification prior to even submitting a loan packet so that we eliminate the potential of problems down the line, but also to find solutions when problems arise in underwriting. If your numbers or paperwork are not initially issue-free, there may yet be ways of obtaining your loan, by whom we choose for your application, by how we present your information to the lender, and/or by providing other, less-traditional supporting documentation.

We have your back!